How can I keep an eye on the growth of my gold holdings?

Investors need vital devices and suggestions to successfully track their gold investment performance. Gold investment represents a timeless journey comparable to embarking on a lengthy sea voyage. The market's changes affect gold prices as a result you should monitor your financial investments on a regular basis. Keeping understanding of my gold investment efficiency needs knowledge of different tools and techniques that allow me to reach informed financial investment decisions. I make use of real-time data from trustworthy systems to accurately determine the value of my gold due to the fact that they supply important market fad insights. Google Sheets works as my device for entering real-time spot costs and carrying out computations to evaluate my existing portfolio holdings. BullionByPost along with the Globe Gold Council deliver real-time charts and data which enable thorough evaluation of rate motions. Through tactical tools I acquire clear insights which enable effective administration of my investment portfolio. Analytical devices and platforms keep me frequently educated regarding the state of my investment portfolio. Setting up market alerts and utilizing charting tools allows me to rapidly react to fluctuations in the gold market. My aggressive method allows me to preserve my investment's well worth while opening opportunities to increase its value as time proceeds.

Key Takeaways

- Use real-time data for accurate investment tracking.

- Leverage online platforms for market insights. Carry out informs and analysis tools to make well-informed financial investment choices.

Understanding Gold Investments

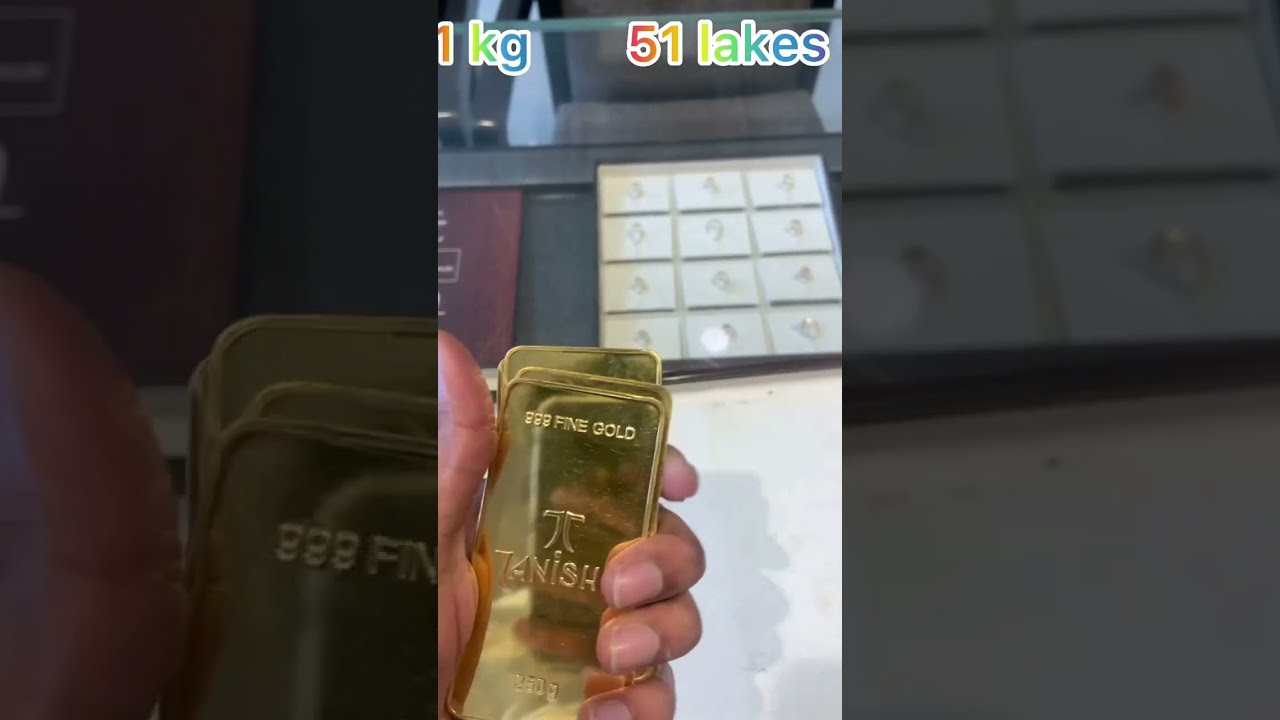

My gold financial investments need me to assess numerous options together with their prospective benefits. Both bullion and gold ETFs provide unique functions and advantages.Types of Gold Investments

I can buy gold with physical forms such as bullion or use versatile choices like ETFs. Physical gold such as bullion and coins offers me with an asset that I can physically possess. Physical gold supplies direct ownership of precious metals which draws in capitalists that favor tangible properties. Gold ETFs call for investors to buy shares which mirror the market worth of gold. This system permits capitalists to trade conveniently on stock exchanges while preserving liquidity and removing storage space issues. Shared funds exist which network financial investments right into gold mining firms and their associated industries. Precious metals shared funds give increased sector exposure and enable profile diversification past gold.Benefits of Buying Gold

Investing in gold provides me several benefits. Financiers make use of gold as a protective action to protect versus inflationary losses. As money values reduce gold costs continue to be steady or increase which helps to preserve my purchasing power.

Gold additionally includes diversity to my financial investments. Gold's movement pattern which is independent from stocks and bonds makes it an important asset for danger decrease. Gold preserves its worth or appreciates during durations of financial instability making it a protected financial investment option. Including gold to my investment portfolio offers both as a wide range guard and as a special property that supplies benefits past other investment alternatives. What is the very best means to keep an eye on the performance of my gold investments? I require to monitor my gold financial investments over time to analyze their efficiency. My first approach for tracking gold investments includes using on the internet platforms that show real-time gold prices and market variations. The website BullionByPost delivers reader-friendly graphes that streamline tracking gold rate motions. Checking my investment portfolio comes to be much easier through the application of Google Sheets I set up Google Sheets to revitalize live area prices which allows me to establish the current well worth of my gold investments rapidly. This approach provides me with an instant review of my financial info. Tools for financial investments such as common fund screeners prove to be useful possessions. Details portfolio analysis devices enable me to evaluate my financial investments consisting of the Integrity Select Gold Portfolio. These tools make it possible for thorough research study and provide performance understandings about several properties. I get thorough information and graphes through the Globe Gold Council's sources. The sources from the Globe Gold Council enable me to base my gold investment choices on strong info. Researchers discover downloadable choices and charting tools especially advantageous. Gold investment worths undergo transform gradually. Real-time data monitoring needs constant updates and source utilization to maintain performance. I make ideal profile decisions by continually examining my investment efficiency.

Analyzing Market Trends

Efficient tracking of gold financial investments needs me to study previous cost patterns together with existing financial conditions. The exam of past price patterns and existing economic problems allows me to clearly recognize market patterns.Historical Gold Prices

The very first step in my analysis includes analyzing historical gold price patterns. Gold has shown its importance as a store of value throughout background. The evaluation of previous information allows me to recognize patterns that take place during financial changes like inflationary periods or money changes. Historic information and graphes act as the key devices I utilize for this analysis. These information collections demonstrate gold's response patterns during times of financial chaos and economic growth. Modifications to rate of interest by central banks generally create gold prices to experience fluctuations. Comprehending historical trends ends up being necessary for me to make exact forecasts about gold prices. With constant monitoring I obtain the ability to forecast future gold price responses when similar scenarios occur. Historical data analysis supplies me with a steady understanding of possible gold cost fluctuations.Current Market Conditions

My evaluation depends heavily on current market conditions. My analysis includes examining inflation rates, money values along with geopolitical occasions. These can all impact gold prices. When inflation boosts individuals commonly buy gold to protect their wealth which results in higher gold prices. Gold's buying power gets influenced when currency worths change. A weaker dollar makes gold much more budget friendly for foreign purchasers which leads to gold rate rises. Monitoring financial growth indications helps me discover changes in market self-confidence and analyze gold's charm. Comprehending current market problems enables me to make educated and timely financial investment decisions.Evaluating Financial investment Strategies

To track my gold investment performance I evaluate both how much time I have actually held my properties and the variety of my financial investment methods. I review which properties to get by taking a look at the advantages of both long-term and temporary financial investment methods while figuring out the optimal means to diversify my portfolio.Long-term vs Short-term Investments

My lasting investment approach involves holding possessions such as gold over multiple years to benefit from their expected slow-moving surge in worth. This technique works to decrease exposure to market variations that take place over short durations. I find the slower buildup of returns acceptable because reduced monitoring fees throughout time supply an economic advantage. I pay much less interest to margin requirements due to the fact that my trading activities are occasional. Short-term investments target quick revenues with active trading procedures. Quick trading enables quick profit possibilities yet may include considerable transaction cost expenditures. Sharper market fluctuations develop monetary dangers for capitalists. I keep track of management costs to avoid them from diminishing my financial returns.Diversification Techniques

I minimize risk across several financial investment types via diversification. I could select to allocate funds to gold and various other assets in addition to supplies and bonds. By executing this specific mix of possessions I can maintain my profile while minimizing monetary losses. Market events lead to distinct feedbacks from various types of financial investments. I actively monitor the performance of my down payments in numerous assets and make adjustments as necessary. I monitor management fees constantly due to the fact that they influence my portfolio's total performance. I choose to disperse my financial investments throughout numerous asset courses. The approach defend against feasible losses while maintaining consistent development purposes.Using Analytical Tools

Investors can streamline gold investment tracking with making use of analytical devices. Investors can utilize a range of software program applications together with professional appointments to obtain much deeper insights regarding market patterns. Selecting proper devices that match your personal investment purposes stays an important step.Financial Software

My gold financial investments become much more transparent with the use of monetary software program. Programs including BullionVault provide tracking tools that deliver real-time rate updates. Normally these tools offer capacities for assessing historical data patterns together with projecting versions. I am able to make educated choices by taking a look at previous gold efficiency information together with future pattern forecasts. Online devices permit me to monitor my profile's performance all day each day. A number of service providers use mobile applications for tracking objectives that operate throughout my whole day. The readily available tools include calculators and charts which streamline data evaluation and potential returns prediction. Financial software program provides me with enhanced insight into my investment portfolio.Expert Examination Services

I keep oversight of my gold investments through assessments with investment experts. Specialist experts use their deep market understanding to offer tailored support which verifies vital for complex decision-making. They describe market changes and offer tactical recommendations that match my financial purposes. Financial investment experts supply remarkable insights beyond what software program devices can create. My portfolio gain from their normal updates concerning market fads and potential investment results. Utilizing expert knowledge allows me to boost my financial investment plans and integrate them with market-wide developments. I improve my gold investment monitoring strategies via their expert guidance.Conclusion

I need to monitor my gold investment efficiency to make educated decisions. Google Sheets stands apart as a valuable tool because it enables me to receive real-time updates on gold rates. The details allows me to quickly track my investment performance. Reliable resources give me with online gold price charts and historical information. The analysis of price fads enables me to establish the best times to acquire or market gold. Financial publications and mobile applications function as convenient resources for staying upgraded.Understanding different market circumstances is also important. The varied efficiency of gold throughout different financial conditions makes recognizing its historic duty in diversified portfolios important for adapting my financial investment methods when essential. I ensure my financial investment selections support my financial objectives by tracking progression through exact information. These approaches provide me with self-confidence in my gold investment management.