Gold as an Investment: Hedge Against Inflation Tactics Reviewed

Gold investments might appear out-of-date however they remain to stand as one of the very best techniques to secure your financial assets. Gold functions as an inflation-resistant property that maintains its purchasing power regardless of climbing prices. Throughout inflationary periods paper currency declines which reduces its buying power. Gold serves as a reputable database of worth since it keeps its worth gradually. Allocating component of your portfolio to gold implies buying a historically steady property that tends to excel when various other kinds of financial investments deal with difficulties. Gold continues to be an eye-catching investment due to the fact that it is accepted throughout the globe. Gold enjoys globally recognition and value while some investments stay restricted to local popularity. Due to the fact that gold has global need it guarantees that your investment will certainly stand wherever you are.

Understanding Gold as an Investment

Lots of view gold as a distinctive asset that works as a dependable shop of worth. Gold works as a vital element for people that want to guard their financial assets. We will certainly take a look at gold's main features along with its historical performance to show why gold stands as a strong financial investment selection.Characteristics of Gold

Gold stands as a rare-earth element prized for its deficiency and lasting stamina. Its resistance to deterioration and tarnish ensures gold serves as a durable store of wealth via generations. Gold does not create revenue like supplies and bonds however obtains its worth from its limited availability and market need. Gold often tends to keep its worth throughout economic instability which makes it a preferred possession for investors when other financial investments shed their well worth. The trading of gold occurs worldwide with its cost influenced by multiple elements like geopolitical events in addition to rising cost of living and currency variations. Gold serves as a globally recognized investment automobile since its global allure establishes it as a trusted icon of financial safety and security.Historical Efficiency of Gold

Gold has actually been an essential economic pressure throughout human background for several centuries. Throughout history, rising cost of living durations caused gold rate increases which compensated for the decrease in money worth by working as an economic secure. Given that 1970 gold rates have experienced substantial growth which escalated during durations of economic crisis. Capitalists turned to gold as a protected financial investment during the 2008 monetary crisis causing a sharp increase in gold rates. Regardless of short-term variations gold keeps a long-lasting pattern of steady increase covering throughout several years. According to historical information gold maintains its value after market changes thus becoming a popular investment choice for lasting wealth preservation.Inflation and Its Effect on Investments

The toughness of your cash to buy items reduces as inflation rises. Inflation considerably affects financial investment strategies and can cause transformed returns.Basics of Inflation

Rising cost of living happens when the prices of products and solutions go up so you require even more money to purchase the same items. Economic climates usually demonstrate health when they experience small inflation. Lots of countries experience a yearly inflation rate in the range of 2-3%. Fast rising cost of living growth can result in your savings falling short to match the boosting costs. Stocks and realty investments offer a protect versus inflationary stress. These properties usually appreciate in value as time passes. Bonds risk losing value due to the fact that their returns stay constant. High inflation rates can make the interest from bonds inadequate to offset the going along with cost rises. Monitoring rising cost of living rates enables you to make much better investment decisions.Inflation Trends Over the Decades

The price of rising cost of living has changed throughout the last a century. Rising cost of living throughout the 1970s reached high levels where the yearly rate hit nearly 14% in particular years. The high inflation prices of the 1970s arised from oil supply shocks and changes in financial policies. The 1980s saw initiatives to control rising cost of living. Rates of interest walks by reserve banks led to a decrease in rising cost of living degrees to a much more sustainable array. Investors today require to think about inflation as one of their primary factors to consider. The recent spike in inflation after years of security arised from supply chain disturbances and changing need patterns. Capitalists that keep an eye on financial patterns can fine-tune their financial investment techniques to select options that carry out well during changing rising cost of living durations. Acknowledging these financial modifications makes it possible for investors to better guard their possessions from depreciation.Gold as a Hedge Versus Inflation

Throughout background people have actually checked out gold as a reputable asset that safeguards buying power throughout inflationary durations when price levels go up. The unique attributes of gold integrated with its historic track record make it an attractive choice for those seeking to safeguard their monetary assets.Mechanics of Hedging With Gold

During times of economic instability people frequently transform to gold as a safe and secure investment choice. As rising cost of living rates rise cash loses its buying power. Gold functions as a value preserver because it usually preserves its worth or experiences gratitude. Financiers have the choice to purchase gold via physical bars and coins or via exchange-traded funds. Gold functions as a physical possession which gives capitalists protection unlike stocks or bonds. Gold does not have the ability to generate dividend income but maintains its worth during economic turbulence.Gold's Correlation with Inflation

Gold costs have constantly enhanced during periods of high rising cost of living throughout history. The pattern emerges due to the fact that capitalists transform to alternatives to cash assets that reduce in acquiring power when prices rise. Gold gets held by reserve banks serve as a strategic measure to attend to inflation problems. Gold prices remain strong during inflationary periods since central bank demand supports them. Examining both rising cost of living rates and gold prices allows you to obtain understanding into their correlation. Understanding this relationship supplies necessary insights for making tactical decisions about adding gold to your financial investment profile.Investing in Gold: Approaches and Vehicles

Numerous techniques exist for people that want to invest in gold. There are numerous financial investment approaches for gold consisting of purchasing physical gold and discovering gold ETFs and common funds or investing in mining stocks and indices. Various financial investment techniques for gold each deal special benefits and downsides.Physical Gold Investment

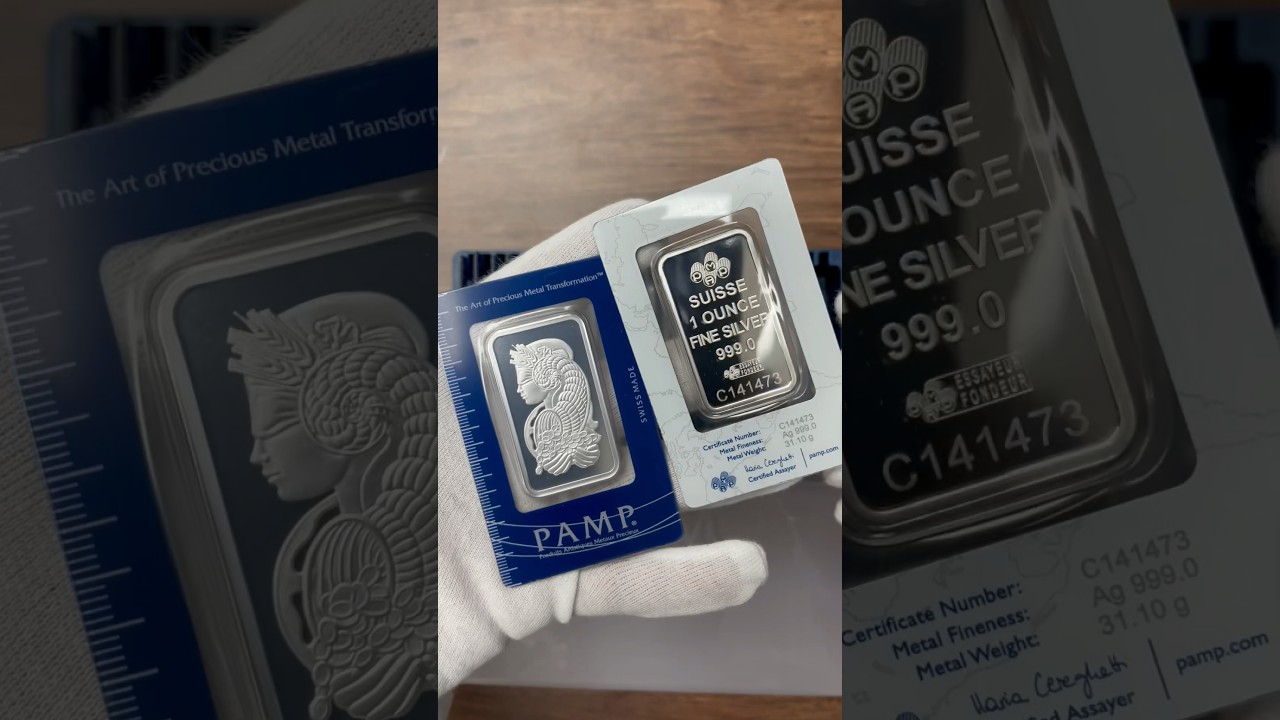

Physical gold investments offer direct possession of tangible properties consisting of coins and bars in addition to jewelry. The appeal of this financial investment comes from the investors having direct possession of the actual steel. The costs of storage space and insurance must be consisted of in your considerations. Safe storage space of your gold calls for either a safe-deposit box or a protected home safe. Physical gold continues to be a trusted method to maintain buying power throughout periods of inflation or monetary instability despite its prices. Collectors may find coins beneficial beyond their gold material due to the fact that this added collectible top quality can lead to possible increases in their well worth.Gold ETFs and Common Funds

Gold ETFs supply financiers with a possibility to gain direct exposure to gold market performance without having to physically possess the metal. The funds run by adhering to gold market prices and are readily available for trading on stock markets. Financiers can trade them through stock exchanges with the simplicity of supply deals. While shared funds enable financiers to include various gold-related assets in their portfolios. These funds include both physical gold holdings and supply shares from mining corporations. Capitalists make use of these alternatives to accomplish profile diversity and they frequently work as stabilizing assets. Investing with these alternatives typically causes reduced charges than buying and preserving physical gold.Mining Stocks and Gold Indices

Purchasing mining stocks suggests acquiring possession in companies that remove and supply gold. The success of the company you purchase together with gold price changes identifies your feasible incomes. Gold indices combine numerous mining supplies to give investors varied exposure. Investments in mining firms can raise in worth when these business regulate their expenses while gold costs go up. Stocks provide growth possibilities but they lug market threats. The capacity for incomes to change exists when operational efficiency differs together with geopolitical problems and ecological regulations.Analyzing Threats and Rewards

Gold investments supply protection against inflation yet need understanding of potential threats. An understanding of your danger tolerance integrated with a well balanced portfolio helps you determine if gold financial investments fit your requirements.Assessing Risk Tolerance

Analyze your risk tolerance prior to determining to invest in gold. Gold rates can alter swiftly. The price of gold leapt from approximately $1,500 to above $2,000 per ounce within numerous months of 2020. Consider lowering your gold financial investments if market value changes make you unpleasant.Think regarding your financial goals also. Is your investment technique focused on achieving instant returns or building long-lasting economic safety? Gold provides much better lasting financial protection considering that it resists inflationary pressures. Considering gold versus other possessions may give you greater confidence in your investment selection.

Diversification and Portfolio Balance

Gold can assist balance your financial investment portfolio when consisted of among a series of properties. Diversification reduces investment risks by distributing funding throughout multiple asset classes consisting of stocks, bonds and realty. Gold displays distinct efficiency patterns contrasted to stocks and bonds that provide defense during market slumps. Achieve portfolio stability by keeping a combination of high-risk and low-risk assets. Assigning between 5% and 10% of your profile to gold possessions generally creates stability. Analyze just how gold should incorporate with your wider financial investment strategy because individual circumstances differ.